The IRS has significantly revised Form 6765, used for claiming the Research and Development (R&D) tax credit / research credit , introducing new requirements that will impact businesses seeking this valuable benefit. While aimed at enhancing reporting clarity, the changes bring a notable increase in data collection and compliance efforts as to what is reported with a tax return.

Key Changes and Their Impact:

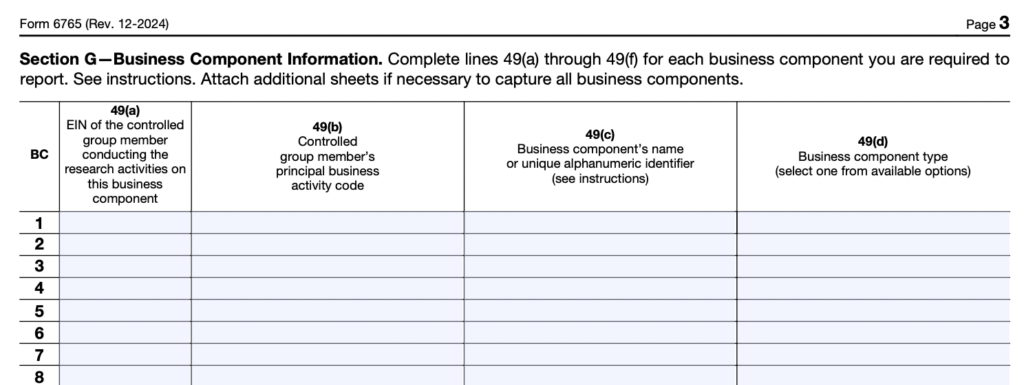

The initial draft of the revised form, released in September 2023, led to a round of some changes based on taxpayer feedback where the IRS streamlined the reporting of business components, now requiring taxpayers to detail only those components that account for 80% of their total Qualified Research Expenses (QRE), with a cap of 50 components.However, this still represents a substantial increase in reporting compared to previous years. The new Section G—Business Component Information demands detailed breakdowns of expenses, activities, and software designations for these key components. To ease the transition, Section G will be optional for the 2024 tax year, becoming mandatory in 2025 (for example tax years ending 12/31/25).

Exemptions for Smaller Businesses:

Recognizing the burden on smaller entities, the IRS has provided exemptions. Qualified Small Businesses (QSBs) electing a reduced payroll tax credit and companies with QREs under $1.5 million and gross receipts under $50 million (when claiming the credit on an originally filed return) are exempt from completing Section G.

New Reporting Sections:

The revised form includes:

- Section E—Other Information: Captures data on the number of business components, officer wages, acquisitions/dispositions, and the use of ASC 730 directives.

- Section F—Qualified Research Expenses Summary: Provides a detailed breakdown of total wages, supplies, computer rental/lease costs, and contract research expenses.

- Section G—Business Component Information: Requires detailed reporting on controlled group members, business component names and types, software designations, research objectives, and expense breakdowns by component.

Implications for the 2024 Tax Year:

For the 2024 tax year, companies claiming the R&D tax credit must to complete Sections E and F. While Section G is optional, understanding its requirements is crucial for the mandatory implementation in 2025.These revisions, while intended to improve reporting accuracy, increasing the requirements for claiming the R&D credit. Businesses should familiarize themselves with the new requirements and ensure they have robust data collection processes in place to comply.