by Bruce Warner | Mar 24, 2025 | Blog

Last week, the IRS has provided crucial guidance on how to properly handle ERC refunds and disallowances, especially for closed tax years, simplifying the process for affected taxpayers who claimed the ERC but were waiting for their refund prior to making adjustments...

by Bruce Warner | Mar 12, 2025 | Blog

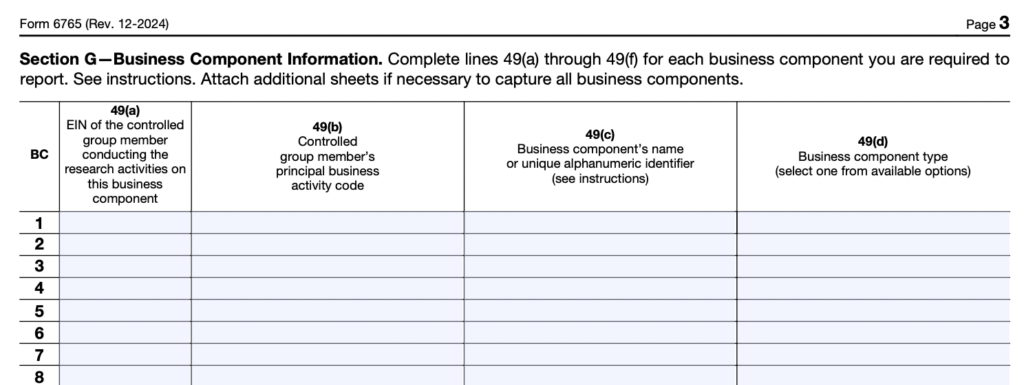

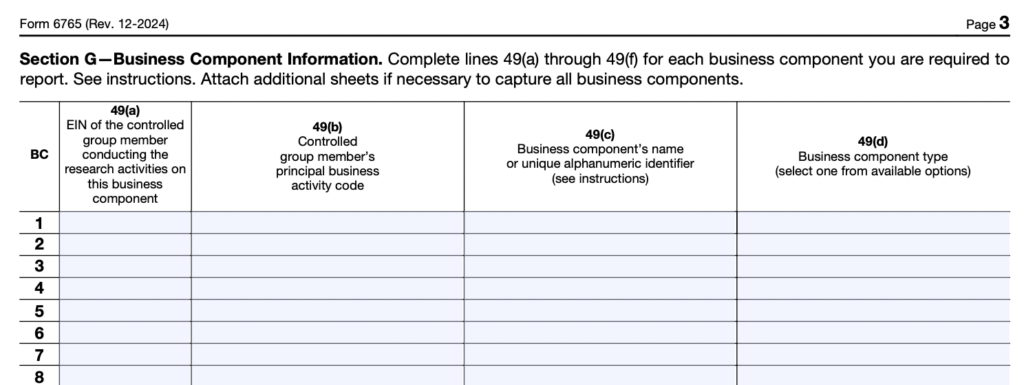

The IRS has significantly revised Form 6765, used for claiming the Research and Development (R&D) tax credit / research credit , introducing new requirements that will impact businesses seeking this valuable benefit. While aimed at enhancing reporting clarity, the...

by Bruce Warner | Jan 14, 2025 | Blog

Although the new Form 6765 R&D tax credit/research credit form is technically not mandatory until tax year 2025, many of our clients are preparing for these changes which are summarized below In 2024, the IRS released a revised Form 6765, which introduces...

by Bruce Warner | Sep 27, 2024 | Blog

Likely no tax bill will be passed until after the 2024 Presidential election, but there is evidence that both parties support deferring or eliminating the amortization of R&D costs, currently 5 years for domestic R&D and 15 years for foreign research costs....

by Bruce Warner | Jun 24, 2024 | Blog

The IRS has released a revised draft of Form 6765, Credit for Increasing Research Activities for the R&D tax credit, incorporating feedback from external stakeholders to reduce taxpayer burden and improve tax administration of the R&D credit. Key changes...

by Bruce Warner | Jan 20, 2024 | Blog

Jan 2024 – In a new bi-partisan bill introduced this week, Congress would again allow immediate expensing of domestic R&D research and development costs, a change from last year’s requirement that 2022 costs must be amortized which kicked in as of 2022 as...