R&D Tax Credits

Many companies have activities that qualify as performing R&D and we’ve been helping with R&D credits for over 25 years…

Energy Tax Credits

Energy Efficient Homes and Apartments

Builders/Developers qualify…

Cost Segregation

Audit Support

Welcome To

Warner Robinson LLC

Warner Robinson provides deep technical expertise in the area of R&D tax credits in assisting clients in documenting and supporting R&D tax benefits. Warner Robinson also serves real estate clients via green tax incentives with the 45L energy efficient home tax credit and the 179D energy efficient building tax deduction, as well as cost segregation studies.

Warner Robinson LLC is led by Managing Directors Bruce Warner and Cedar Robinson who are personally involved with each project.

Find out if you qualify for valuable

Tax Credits and Incentives

Cedar Robinson & Bruce Warner

Bruce Warner

Managing Director

Cedar Robinson

Managing Director

Art Merriman

Senior Manager

Angelique Garcia

Manager

Software App Developer

R&D Tax Credit

$240,000 in R&D Credits

Energy Tax Credit

Single Family Home Builder

$320,000 in Energy Credits

Cost Segregation Study

Office Building

$300,000 in first year accelerated depreciation deductions

IRS Clarifies Income Tax Handling of ERC Refunds – Employee Retention Credit

Last week, the IRS has provided crucial guidance on how to properly handle ERC refunds and disallowances, especially for closed tax years, simplifying the process for affected taxpayers who claimed the ERC but were waiting for their refund prior to making adjustments...

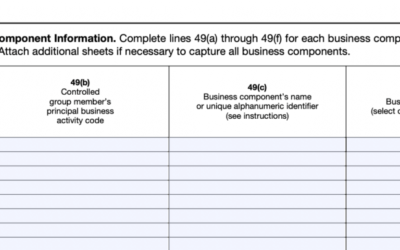

IRS Revamps Form 6765, Bringing Significant Changes to R&D Credit Reporting Sec. 41 Research Credit Form

Research Credit changes with new IRS Form 6765 R&D Tax Credit

Preparing for New Form 6765 R&D Tax Credit

Although the new Form 6765 R&D tax credit/research credit form is technically not mandatory until tax year 2025, many of our clients are preparing for these changes which are summarized below In 2024, the IRS released a revised Form 6765, which introduces...